A Leading Microfinance Bank in Nigeria.

Get a fast and flexible loan

in less than 10 minutes

Get easy access to quick loan with no collateral. Settle your financial needs with ease and fast!

Apply for MTloans

Support Email

mails@mutualtrustmfb.com

Excellent Banking

Save Smart, Spend Wisely. Take Control of Your finances

Flexible Loan

We provide fast access to funds for urgent financial needs.

Fast & Friendly Support

We provide 24 hours support for all customer.

Excellent financial products to help you with your financial needs

IPPIS Loan

Prompt Cash Loans for FG Civil Servants

Put your financial worries to rest with our fast and easy IPPIS loans. Pay your rent, school fees, medical expenses and other financial needs at a go.

Apply for IPPIS Loan

MTGreen:

Say goodbye to high costs of fuel and electricity today

Enjoy uniterrupted power supply to your homes, shops, and offices. Get a quality and affordable solar energy system with flexible repayments ranging from 1 to 12 months

Apply for MTGreen

MTloan:

Get your loan approved in 10 minutes or less!

Enjoy quick access of up to N1 million naira in just 10 minutes or less! Settle your financial needs with no hassle. No collateral is required.

Apply for MTloans

SME Loan:

Beta Business, Beta Moni

Your business deserves the right amount of funds and that’s where we come in. Get easy access to funds of up to N100 million to take your business to the next level.

Car4Cash:

Your Car can be much more!

Do you have a car and you need quick funds? Explore the value of your and get the funds that you need.

Apply for Car4Cash

Investment:

Grow your funds with us

Grow your wealth with us and Enjoy guaranteed Return on investments with us. Security guaranteed with easy liquidation

Invest With Us

100%+

Discover our top services

We offer a range of financial services tailored to meet your personal and business needs. Here’s a look at our top services

OUR BUSINESS FOCUS

Clients Reviews

Mutual Trust MFBank: Trusted by thousands worldwide, endorsed by industry leaders.

Frequently Asked Question

Need A Support?

This is due to a compulsory CBN policy to Microfinance Banks for KYC requirements.

We charge a monthly interest rate of 3% to 4% depending on the loan conditions.

To apply for an IPPIS loan; we need your ID card or employment Letter, pay slip, and a recent passport photograph.

Getting a fast loan after analysis and approval takes only 10 Hours.

Getting a fast loan after analysis and approval takes only 10 Hours.

Getting a fast loan after analysis and approval takes only 10 Hours.

To apply for an IPPIS loan; we need your ID card or employment Letter, pay slip, and a recent passport photograph.

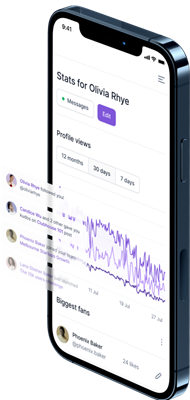

Ready To Download

Your can do more on our mobile applications. Download from App Store or Google Play.