Access the tools and equipment to grow your agricultural business

Boost your agricultural business with our Agric Asset Finance, designed to provide flexible financing for essential tools, machinery, and equipment. We understand the unique challenges faced by agribusinesses and offer tailored solutions to help you increase productivity, reduce costs, and improve profitability. With competitive interest rates, easy application, and quick approval, our Agric Asset Finance is here to support sustainable growth in the agricultural sector.

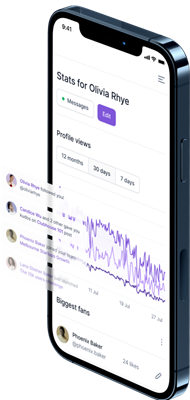

Your can do more on our mobile applications. Download from App Store or Google Play.