Empower your business with our SME Loans

Empower your business with our SME Loans tailored specifically for small and medium enterprises. With favorable terms and fast approval, we help SMEs access the capital needed for expansion, working capital, or equipment financing

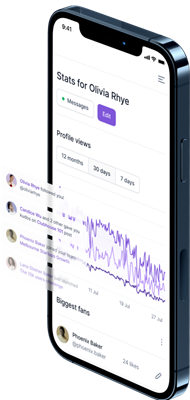

Your can do more on our mobile applications. Download from App Store or Google Play.